There’s no doubt buying a home today is different than it was over the past couple of years, and the shift in the market has led to advantages for buyers today. Right now, there are specific reasons that make this housing market attractive for those who’ve thought about buying but have sidelined their search due to rising mortgage rates.

Buying a home in any market is a personal decision, and the best way to make that decision is to educate yourself on the facts, not following sensationalized headlines in the news today. The reality is, headlines do more to terrify people thinking about buying a home than they do to clarify what’s going on with real estate.

Here are three reasons potential homebuyers should consider buying a home today.

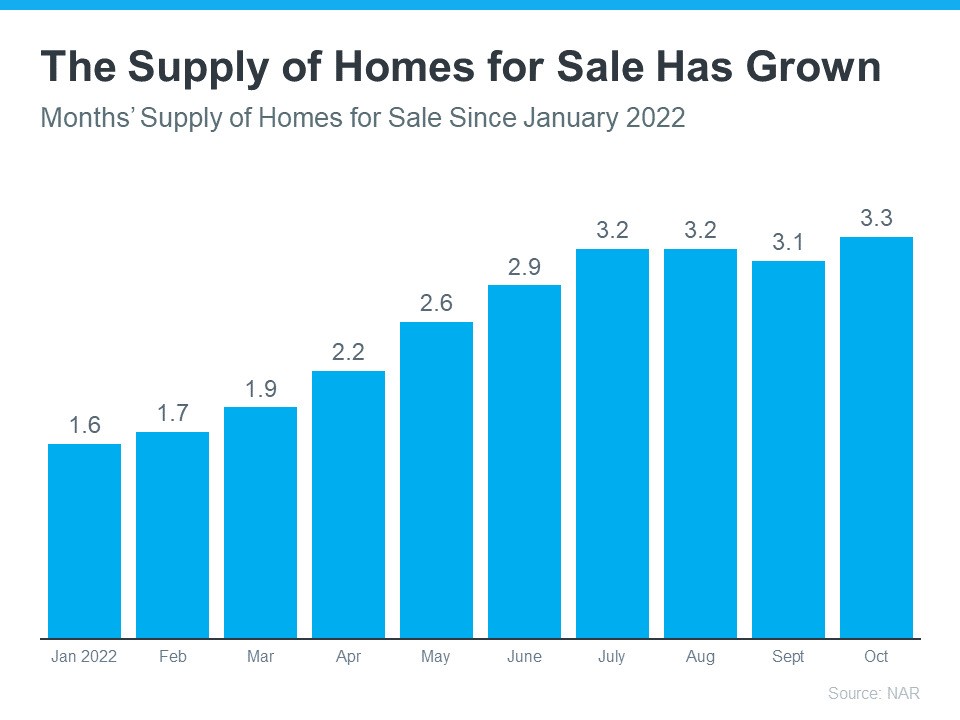

MORE HOMES ARE FOR SALE RIGHT NOW

According to data from the National Association of Realtors® (NAR), this year, the supply of homes for sale has grown significantly compared to where we started the year (see graph below):

This growth has happened for two reasons: homeowners listing their homes for sale and homes staying on the market a bit longer as buyer demand has moderated in response to higher mortgage rates.

The good news for you is that more inventory means more homes to choose from. And when there are more homes on the market, you could also see less competition from other buyers because the peak frenzy of competing over the same home has eased too.

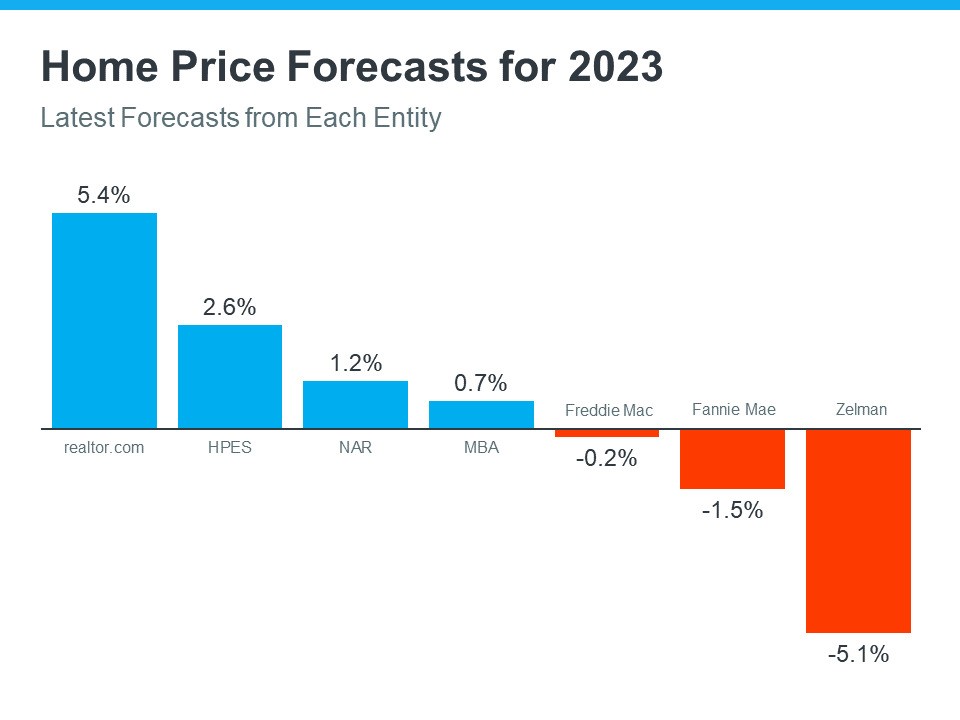

HOME PRICES ARE NOT PROJECTED TO CRASH

Experts don’t believe home prices will crash as they did in 2008. Instead, home prices will moderate at various levels depending on the local market and the factors, like supply and demand, at play in that area. That’s why some experts are calling for slight appreciation and others are calling for slight depreciation (see graph below):

If you consider the big picture and average the expert forecasts for 2023 together, the expectation is for relatively flat or neutral price appreciation next year. So, if you’re worried about buying a home because you’re afraid home prices will